In partnership with Salesforce, CPI developed this corporate climate finance playbook to help corporate decision makers accelerate climate finance strategies by:

- examining the strategic use of various financial instruments to deploy, manage, and raise capital,

- sharing insights on how and when to use them, and

- highlighting best practices in corporate climate finance.

The Playbook seeks to answer three core questions:

1. What financial instruments are available in the corporate capital stack, and how can they be applied to climate?

Corporations engage with capital through three core mechanisms:

- Capital Deployment: Strategically allocating the full swath of financial resources available in order to achieve specific business or project objectives.

- Capital Management: Financial instruments used to manage a company’s assets and equity against its liabilities to ensure the organization meets its financial obligations and achieves its goals.

- Capital Raising: Raising net-new external funds to achieve and/or advance strategic goals for a business, project, or team.

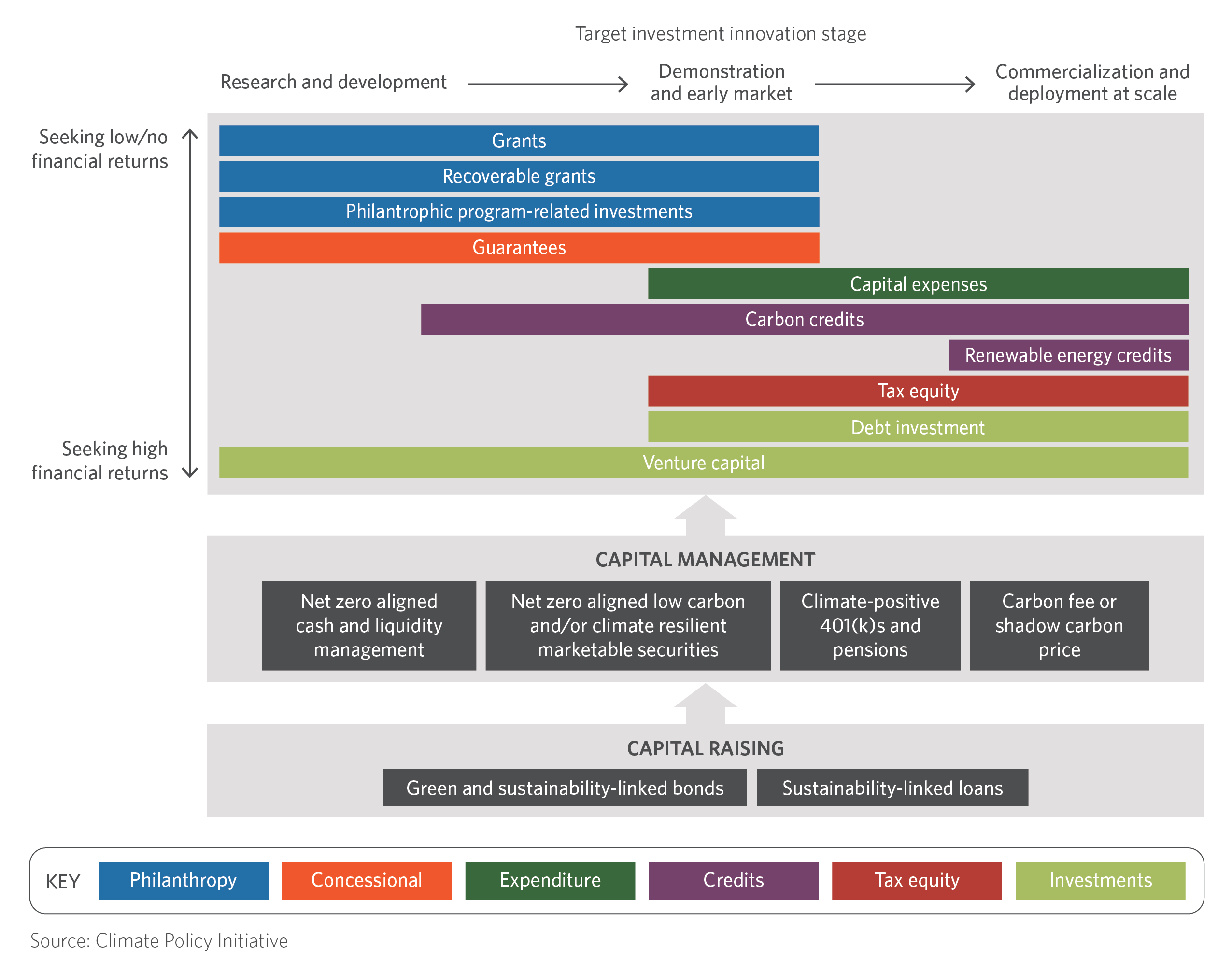

The Playbook includes a taxonomy of commonly available corporate climate finance instruments, ranging from green bonds and sustainability-linked loans, to internal carbon pricing, net zero aligned cash and liquidity management and climate-positive 401(k) options, to grants, venture capital, capital expenses, and carbon credits.

Figure 1: Map of corporate climate finance instruments

2. When and how can each instrument be used, and what are the climate and business considerations?

One company’s rationale for using philanthropy or venture capital will look different from another’s depending on goals, resources, stakeholder buy-in, previous experience, organizational structure, and more. Figure 2, the decision-making flowchart, is intended to guide individuals through the steps one might consider when choosing and implementing a particular climate finance instrument.

Figure 2: Decision-making flowchart

3. What are corporations already doing and how can their models be applied to another company’s journey?

The Playbook also showcases real-life examples of companies applying these instruments to their own climate finance strategies and specific considerations for how to apply them to your own. This includes stories from Cisco Foundation, Microsoft, Seventh Generation, Salesforce, and Autodesk. These examples can serve as inspiration for companies, no matter where they are on their climate finance journey.

The Playbook is designed to be a practical guide to help companies unlock the full power of their business to reach their climate goals.

No matter where you are in your journey, here are five tips to start or grow your own corporate climate finance playbook:

1. Understand your goals, and the tradeoffs you’re willing to make. There’s no ‘silver bullet’ when it comes to climate finance. Each instrument and approach will have its risks and benefits. Clarify what your climate and business goals are so you can understand what to optimize for in a climate finance strategy.

2. Work with key stakeholders to weigh these objectives and gain buy-in. No good climate finance strategy is built in isolation. Talk to your internal and external stakeholders to understand their priorities and align on what’s most important.

3. Explore your climate finance options and what it would take to activate them. Take the time to understand what each financial instrument is best suited for, the level of effort required, and the implications on your business and climate goals. Be realistic about what’s possible given your resources and priorities.

4. Put it all together to build a holistic climate finance strategy that optimizes for your goals, using your limited resources. To take your dollars further, it’s critical to leverage multiple forms of capital, and in coordination with one another. Strategically match financing approaches to the appropriate climate initiative to advance one integrated strategy. And if now isn’t the right time to seek new funds or investments, tap the existing instruments already at your disposal.

5. Be ready for the right moment, with the right climate finance plan. When the CEO is headed to COP, new legislation is passed, or a competitor announces a major climate commitment and senior leadership asks “what’s our plan?”, you’ll be prepared to present a holistic climate finance strategy.