Recap for October 17

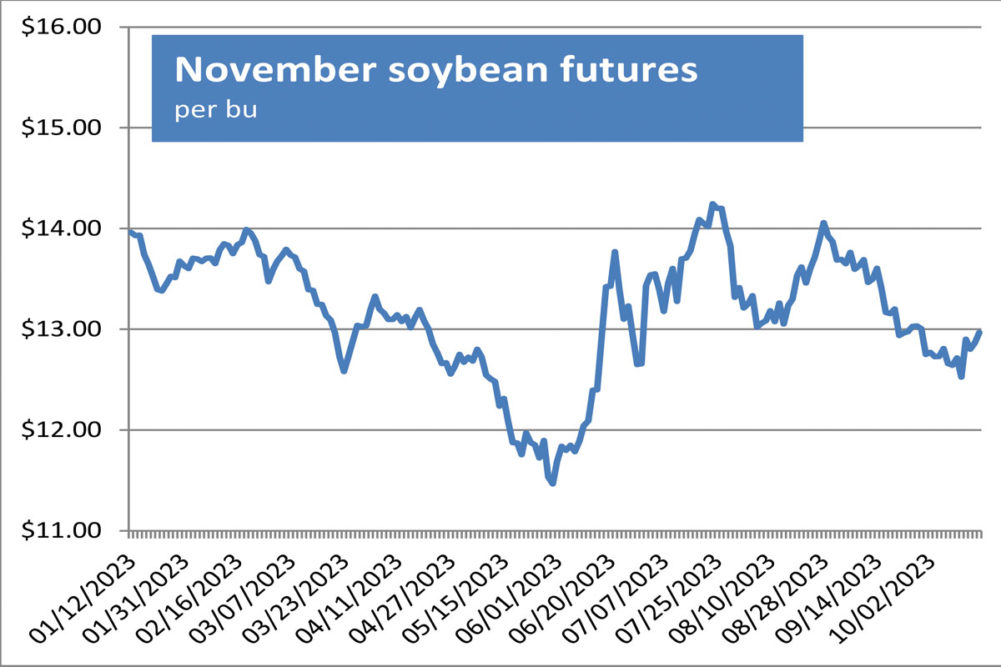

- Strong domestic demand eased concerns about larger supplies, helping to boost soybean futures on Tuesday in thin technical trading. With little fresh news to drive the bulls, corn futures slipped lower Tuesday, a day after the USDA pegged corn harvest at 45% completed. Wheat futures declined in profit taking after Chicago contracts hit two-week highs on the strength of export market enthusiasm after China’s second weekly soft red winter wheat purchase. December corn futures dropped 1¢ to settle at $4.89 per bu. Chicago December wheat fell 6¾¢ to close at $5.70½ per bu; 2025 contracts were higher. Kansas City December wheat eased 2¢ to close at $6.66¾ per bu. Minneapolis December wheat fell 1¢ to close at $7.27¾ per bu. November soybeans added 10½¢ to close at $12.96¾ per bu. December soybean meal added $9.60 to close at $399.88 per ton. December soybean oil dropped 0.55¢ to close at 55.35¢ a lb.

- US equity markets were mixed Tuesday after Commerce Department data indicated September online, in-store and restaurant spending rose a stronger-than-expected 0.7% from a month earlier, and after treasury yields jumped higher, the benchmark 10-year bond yield rising to 4.846%, up from 4.709% Monday, to the highest closing level since July 2007. The Dow Jones Industrial Average edged up 13.11 points, or 0.04%, to close at 33,997.65. The Standard & Poor’s 500 eased 0.43 point, or 0.01%, to settle at 4,373.20. The Nasdaq Composite fell 34.24 points, or 0.25%, to close at 13,533.75.

- US crude oil prices were steady to higher Tuesday. The November West Texas Intermediate light, sweet crude future was unchanged at $86.66 per barrel and the December contract closed up 18¢ at $85.44.

- The US dollar index reversed course and strengthened on Tuesday.

- US gold futures edged higher Tuesday. The October contract added $1.60 to close at $1,922.70 per oz.

Recap for October 16

- Soybean oil futures jumped Monday after the National Oilseed Processors Association indicated soybean oil stocks had tumbled to nine-year lows. Soybeans advanced after export inspections came in above analysts’ estimates. Corn futures declined under mild harvest pressure, projections for ample corn stocks, and forecast for hot dry weather conducive to harvest this week. Spring wheat futures advanced, but winter wheat futures were under pressure from Russia’s lower wheat prices and were also in a profit taking setback after rising last week to two-week highs when China’s soft red winter wheat purchases ignited hopes for a renewed world demand for US supplies. December corn futures shed 3¼¢ to settle at $4.90 per bu. Chicago December wheat fell 2½¢ to close at $5.77¼ per bu. Kansas City December wheat eased ¼¢ to close at $6.68¾ per bu. Minneapolis December wheat added 6¾¢ to close at $7.28¾ per bu. November soybeans added 6¢ to close at $12.86¼ per bu. December soybean meal edged up 20¢ to close at $390.20 per ton; later months were mixed. December soybean oil added 1.52¢ to close at 55.90¢ a lb.

- While gold prices and US treasury bond yields declined, US equity markets moved higher Monday on investor hopes that war in the Middle East wouldn’t have a major impact on the global economy. The Dow Jones Industrial Average advanced 314.25 points, or 0.93%, to close at 33,984.54. The Standard & Poor’s 500 added 45.85 points, or 1.06%, to settle at 4,373.63. The Nasdaq Composite added 160.75 points, or 1.2%, to close at 13,567.98.

- US crude oil reverted to the low side Monday. The November West Texas Intermediate light, sweet crude future lost $1.03 to close at $86.66 per barrel.

- The US dollar index weakened Monday.

- US gold futures pulled back on Monday. The October contract fell $6.30 to close at $1,921.10 per oz.

Recap for October 13

- US gold futures surged on Friday as investors flocked to safe-haven investments amid rising tensions in the Middle East. Early Friday, the Israeli military sent evacuation notices to Gaza citizens ahead of an alleged assault. The October contract jumped $58.10 to close at $1,927.40 per oz.

- Profit-taking brought soybean futures lower Friday after rallying a day earlier on the USDA’s decreased estimates of harvest. Corn followed soybeans lower. Wheat rallied in Chicago on improved export signs after China’s second weekly purchase of soft red winter wheat. Deferred Chicago contracts and all KC and Minneapolis wheat futures declined. Grain and oilseed futures were under pressure from a decline in consumer sentiment and inflation worries. December corn futures shed 2¾¢ to settle at $4.93¼ per bu. Chicago December wheat added 8¼¢ to close at $5.79¾ per bu; September 2024 future and beyond were lower. Kansas City December wheat fell 6¢ to close at $6.69 per bu. Minneapolis December wheat eased 1½¢ to close at $7.22 per bu. November soybeans dropped 9¾¢ to close at $12.80¼ per bu. December soybean meal dropped $2.90 to close at $390 per ton. December soybean oil added 1.01¢ to close at 54.38¢ a lb.

- Threats of a widening conflict in the Middle East had investors pulling out of the stock market and entering safe-haven assets on Friday. Still, the Dow industrials index posted a small gain Friday and was higher for the week, as was the S&P 500. The Dow Jones Industrial Average advanced 39.15 points, or 0.12%, to close at 33,670.29. The Standard & Poor’s 500 declined 21.83 points, or 0.5%, to settle at 4,327.78. The Nasdaq Composite fell 166.98 points, or 1.23%, to close at 13,407.23.

- US crude oil flipped to the high side Friday. The November West Texas Intermediate light, sweet crude future jumped $4.78 to close at $87.69 per barrel.

- The US dollar index strengthened again Friday.

Recap for October 12

- US corn and soybean futures prices climbed Thursday after the USDA lowered its projections for the harvest of both crops as hot, dry weather during key development phases cut into yields. Wheat futures followed corn and soybeans higher despite non-supportive estimates from the USDA, which raised its estimate for the 2024 wheat carryover by 55 million bus from September. December corn futures gained 8¢ to settle at $4.96 per bu. Chicago December wheat packed on 15½¢ to close at $5.71½ per bu. Kansas City December wheat added 7¾¢ to close at $6.75 per bu. Minneapolis December wheat advanced 5¼¢ to close at $7.23½ per bu. November soybeans leaped 37½¢ to close at $12.90 per bu. October soybean meal rose $13.30 to close at $387.60 per ton. October soybean oil added 0.95¢ to close at 54.47¢ a lb.

- Commerce Department data showed inflation-squelching progress of summer took a pause in September and US equity markets closed lower. Data showed the Consumer Price Index rose 3.7% from September 2022, the same as in August. Core prices, which exclude the volatile food and energy categories, rose 4.1% from September 2022, down from 4.3% in August. The Dow Jones Industrial Average advanced 173.73 points, or 0.51%, to close at 33,631.14. The Standard & Poor’s 500 fell 27.34 points, or 0.62%, to settle at 4,349.61. The Nasdaq Composite dropped 85.46 points, or 0.63%, to close at 13,574.22.

- US crude oil declined again Thursday. The November West Texas Intermediate light, sweet crude future shed 58¢ to close at $82.91 per barrel.

- The US dollar index strengthened again Thursday.

- US gold futures busted its four-day win streak as the October contract dropped back $3.50 to close at $1,869.30 per oz.

Recap for October 11

- Soybean futures declined Wednesday despite expectations that the USDA would trim US soybean production and yields in its Oct. 12 Agricultural Supply and Demand Estimates (WASDE) report. The unexpected pressure came from ideas soybean yields and production would remain near the high end of trade estimates. Corn futures advanced ahead of the report in which analysts expected the USDA to drop corn production estimates from 15.134 billion bus in September to 15.101 billion bus and to drop corn yields from 173.8 bus per acre in the prior month to 173.5 bus an acre. The average domestic corn ending stock estimate was 2.138 billion bus, down from 2.221 billion bus in September. Wheat futures were lower under pressure from Black Sea wheat supplying the world market and as traders positioned themselves ahead of a WASDE report expected to show an increase in the USDA’s June 1, 2024, US wheat carryover. December corn futures added 2½¢ to settle at $4.88 per bu. Chicago December wheat dipped 2½¢ to close at $5.56 per bu. Kansas City December wheat dropped 4¢ to close at $6.67¼ per bu. Minneapolis December wheat declined 5¼¢ to close at $7.18¼ per bu. November soybeans dropped 19¢ to close at $12.52½ per bu. October soybean meal added $2.30 to close at $374.30 per ton; all subsequent months were lower. October soybean oil fell 0.47¢ to close at 53.52¢ a lb.

- US equity indexes extended their win streak to four days Wednesday as a swift run-up in bond yields pulled back and the Fed indicated it could be done with interest rate hikes as long as long-term yields remain near highs and inflation continues to cool. The Dow Jones Industrial Average advanced 65.57 points, or 0.19%, to close at 33,804.87. The Standard & Poor’s 500 gained 18.71 points, or 0.43%, to settle at 4,376.95. The Nasdaq Composite added 96.83 points, or 0.71%, to close at 13,659.68.

- US crude oil declined again Wednesday. The November West Texas Intermediate light, sweet crude future shed $2.48 to close at $83.49 per barrel.

- The US dollar index strengthened Wednesday.

- US gold futures continued higher for a fourth-straight trading day Wednesday. The October contract rose $11.80 to close at $1,872.80 per oz.

Ingredient Markets

| Fresh ideas. Served daily. Subscribe to Food Business News’ free newsletters to stay up to date about the latest food and beverage news. |

Subscribe |