.

.UK inflation unexpectedly dipped in December for the first time in three months as hotel prices fell and tobacco costs eased.

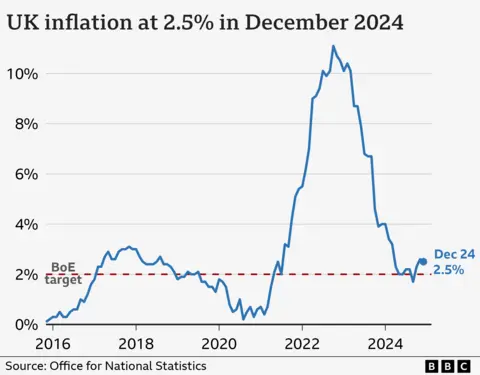

Prices rose 2.5% in the year to December, down from 2.6% the month before, the Office for National Statistics (ONS) said.

Despite the rate of price rises remaining above the Bank of England’s target, expectations of an interest rates cut next month have grown.

The latest figures also ease pressure on Chancellor Rachel Reeves, who has faced criticism following a slump in the value of the pound and government borrowing costs hitting the highest level for several years.

Borrowing costs fell back to last week’s levels early on Wednesday and the pound rose slightly to stand at $1.22 as traders reacted to the unexpected inflation drop.

Easing price rises in restaurants and falling hotel prices last month helped the overall inflation rate come down, as well as prices for tobacco, clothing, and footwear increasing at a slower pace than in December 2023.

But Grant Fitzner, chief economist of the ONS, said this was offset by the rising cost of fuel and second-hand cars.

Inflation is much lower than its peak in October 2022 when prices soared, pushing up the cost of living for households and leading to higher interest rates, which has made the cost of loans, credit cards and mortgages, more expensive.

Falling inflation does not mean prices are decreasing, but are now rising at a slower pace.

Economists had expected inflation to remain unchanged last month, so the falling rate will be welcome news for Reeves, who has hit back at critics and pledged to go “further and faster” to improve the UK’s stagnant economic growth.

She said there was “still work to be done to help families across the country with the cost of living”, but added the government had “taken action to protect working people’s payslips from higher taxes” and increased the minimum wage.

“We were clear that growth is our number one priority to put more money in the pockets of working people,” she said.

Shadow chancellor Mel Stride said economic growth had been “killed stone dead by this government” and called for Reeves to “urgently explain how she will now achieve this”.

In response to turbulence in the markets in recent days, it is understood the chancellor will now bring forward announcements from Labour’s promised industrial strategy within the next two weeks.

Jane Sydenham, investment director at Rathbones Investment Management, said a weak pound tended to signal a “lack of confidence” in the UK economy.

She told the BBC’s Today programme investors needed to “see some detail” on the UK’s plans. “Are there going to be some tax breaks for certain industries? I think specifics and action is what the market wants to see,” she added.

‘You can only charge so much’

Jonny Gettings, director of operations at Italian restaurant and small hotel Ennio’s in Southampton, told the BBC the hospitality business was being hit by rising costs from produce and ingredients, to staff wages and utility bills.

He said the outlook for the business appeared “considerably worse” with increases to the minimum wage and national insurance contributions and reductions to business rates relief on the horizon.

“It will undoubtedly have a considerable impact on the way we run our business,” he said. “Our staff are our biggest asset and the worry is the balancing act is making sure that we don’t impact on their future employment.”

Mr Gettings said cutting staff working hours would be the “last scenario”, but said the restaurant could look at shrinking its menu size, review its suppliers, or change opening hours.

“As soon as you increase the prices, you’ve got another bunch of problems to deal with, because then the worry is the customers will vote with their feet and they’ll go and eat elsewhere,” he added.

“You can only charge so much for a menu item before the guest is going to say, ‘well, hang on a minute’.”

‘More rate cuts’

Michael Saunders, a former member of the Bank of England’s monetary policy committee which sets interest rates, said the latest inflation figure would be “some help” in trying to ease some of the worries over UK interest rates.

“If it stays like this, we will be on route to slightly more interest rate cuts,” he told BBC’s Today programme.

The Bank of England decided to hold interest rates at 4.75% last month, after policymakers said the UK economy had performed worse than expected, with no growth at all between October and December.

It will next set rates in February, but inflation remains over the Bank’s 2% target.

However, Ruth Gregory, deputy chief UK economist at Capital Economics said the lower-than-expected inflation figure for December “strengthens the case” for a 0.25 percentage point cut next month.

But there are concerns inflation could rise further, with firms warning they will raise prices to cover tax rises coming into force in April and the threat of potential trade taxes imposed by the US, with president-elect Donald Trump pledging a 20% tariff on all imports.