mbbirdy/iStock via .

The Company

Accel Entertainment, Inc. (NYSE:ACEL) is a $1-billion market cap distributed gaming operator in the United States, involved in the installation, maintenance, and operation of gaming terminals, redemption devices with ATM functionality, and other amusement devices in authorized non-casino locations like restaurants, bars, convenience stores, and more. They also offer gaming solutions to location partners to enhance player engagement. Additionally, the company operates stand-alone ATMs and provides various amusement devices, such as jukeboxes, dartboards, and pool tables, for entertainment purposes. Headquartered in Burr Ridge, Illinois, the company aims to be a preferred partner for local business owners in the markets they serve.

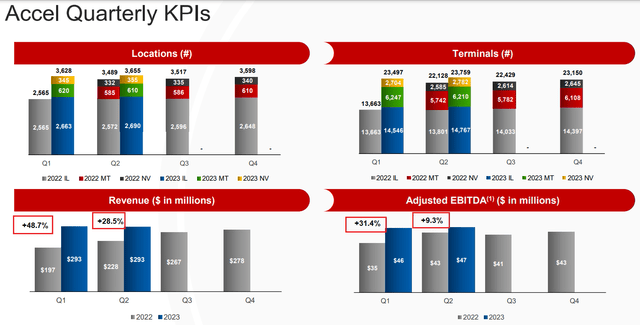

Last year they expanded their operations through the acquisition of Century Gaming, Inc., which is now fully integrated [according to the management’s words during the latest earnings call] and drives the top-line growth we saw in Q2 FY2023:

ACEL’s IR materials, author’s notes

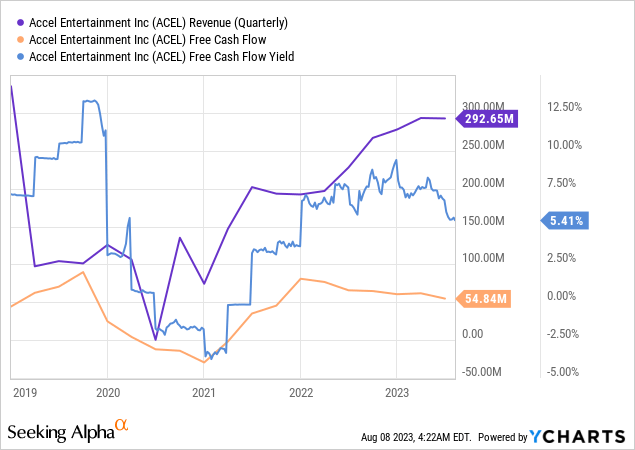

In Q2 FY2023, ACEL had a record-breaking second quarter with revenue of $293 million, a YoY increase of 28%, and adjusted EBITDA of $47 million, a YoY increase of 9%. The company had 23,759 terminals and 3,655 locations, with YoY increases of 7% and 5%, respectively. CapEx for the quarter was $20 million [+212% YoY], mainly due to accelerating purchases in Illinois and investment in developing markets like Nebraska and Georgia. So the FCF dropped QoQ slightly, but in terms of the FCF yield of [~5.4%] we see nothing dramatic here:

The executives believe that the integration of Century has been successful, and while the company has extracted some synergies, they see more opportunities for growth and improvement in the future.

Right now, inflation [especially labor costs] is putting pressure on the company’s gross margin, and macroeconomic uncertainty is preventing management from providing clear guidance on future growth. What also confuses me is the fact that sales growth – even though it looks quite impressive now against the backdrop of a low 2022 baseline – is facing headwinds in the form of declining location attrition [primarily due to the closure of low-performing locations] and unfavorable weather conditions.

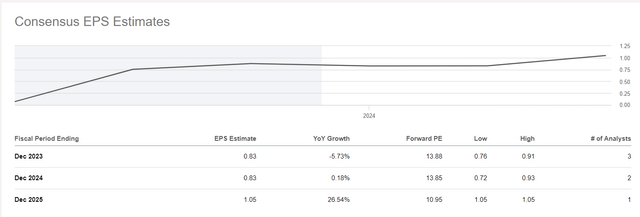

On a TTM-by-quarter basis, ACEL’s net income decreased by 1.52% YoY, and Wall Street analysts expect it to keep on shrinking, racing a full-year YoY decline of -5.73% by the end of fiscal 2023:

Seeking Alpha, ACEL’s Earnings Estimates

The company is predicted to have flat earnings per share momentum in 2024, but I have doubts about how realistic these forecasts are.

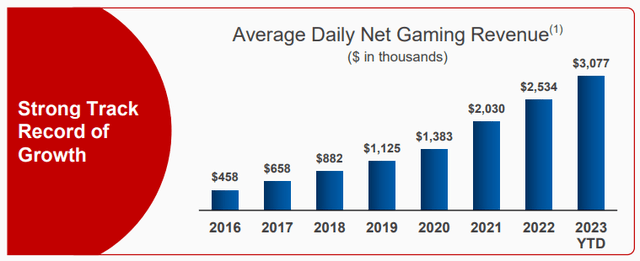

First, FCF generation looks quite stable, even after the CAPEX growth of >200% YoY in Q2. It makes sense for the company to invest as the gaming business continues to recover. An interesting fact: the coronavirus did not have much impact on ACEL’s average daily net gaming revenue, which grew in 2020-2021 and continues to grow in the current year. The denominator in calculating this metric is the number of trading days, so the amount of revenue did not depend on this metric when casinos were under quarantine.

ACEL’s IR presentation

That is, on average, the company’s terminals bring more per 1 working day from year to year. And the number of ACEL’s terminals, as we recall, continues to grow. Against the background of the continuing return of people to the gambling halls, I assume that this should play into the hands of a further recovery of the company’s revenues and, consequently, the amount of net profit.

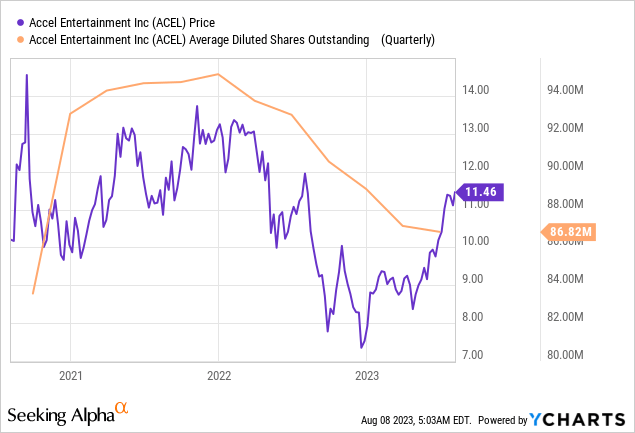

Second, the number of shares outstanding is likely to decline further, leaving room for growth in EPS. The company recently announced a $200 million share repurchase program [~20% of the total amount] and has repurchased $8.1 million worth of stock as of the latest quarter.

As of June 30, Accel had ~$285 million of net debt and $575 million of liquidity, consisting of cash and available credit. I think that the strong financial position as well as the FCF generation power should allow ACEL to successfully implement its share buyback plan this and next year. Therefore, the complete lack of EPS growth in FY2024 seems to be too pessimistic an assumption.

But how does ACEL’s valuation support my bullish arguments?

The Valuation

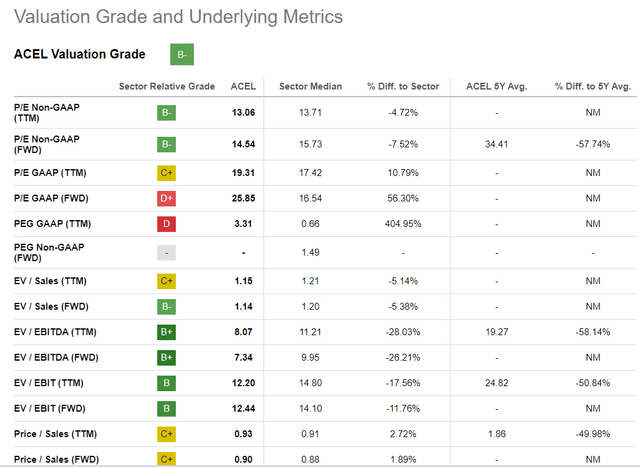

Seeking Alpha assigns a “B-” Valuation grade to ACEL stock because it has a lot of low EBITDA- and Sales-related multiples compared to the entire Consumer Discretionary sector, but there are also some concerning signs regarding GAAP P/E and PEG ratios:

Seeking Alpha, ACEL, Valuation

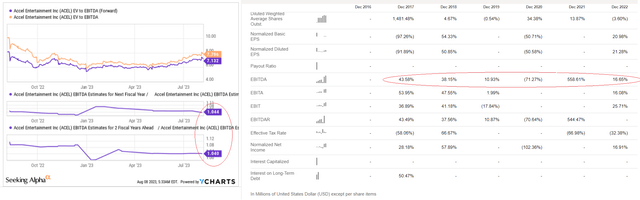

Focusing on the EBITDA-related multiples and EBITDA growth rates, we find much the same as with the EPS forecast: analysts are estimating meager EBITDA growth for FY2024 and FY2025, while the company has historically grown much faster:

YCharts, Seeking Alpha, author’s notes

I think that if the company’s recovery continues, the market may assign it a higher valuation multiple. So an EV/EBITDA of ~10x would look appropriate [that’s about the industry’s median value], resulting in an enterprise value of ~$1,853M next year at a projected EBITDA of $185.31 [YCharts data], which is ~60% above today’s market cap when adjusted for ACEL’s net debt figure.

The Bottom Line

In general, ACEL has obviously had some difficulties in recent quarters, as the number of operating days has fluctuated constantly, resulting in insufficient revenue to maintain margins. Due to the many macroeconomic risks and the fact that management has not provided clear guidance for the near future, ACEL stock carries many risks that any potential investor should consider. Perhaps the Wall Street analysts are right: earnings per share could actually stay in the same place next year (or even fall further). If so, ACEL stock will most likely show declining momentum from here.

However, looking at the latest operating numbers, ACEL’s business looks relatively good. FCF generation is still strong, which should be enough for new accretive M&A deals and buybacks. The operational metrics look promising – I’m talking about ACEL’s average daily net gaming revenue, which is steadily increasing. I expect ACEL’s business expansion to continue as gaming traffic strengthens and recovers. So I personally don’t think EPS should stay the same. It will likely increase next year, which should give the stock price a boost when/if multiple expansion occurs.

Therefore, I rate ACEL stock as a “Buy” this time.

Thanks for reading!