A version of this post first appeared on TKer.co

Stocks climbed last week with the S&P 500 rising 1.0% to close at 4,582.23. The index is now up 19.3% year to date, up 28.1% from its October 12 closing low of 3,577.03, and down 4.5% from its January 3, 2022 record closing high of 4,796.56.

The market rallied as we were reminded not to underestimate the American consumer.

On Friday, the BEA reported that personal consumption expenditures growth accelerated in June, rising to a record annualized rate of $18.4 trillion.

This matters because consumer spending is the dominant driver of the U.S. economy, with personal consumption expenditures accounting for 68% of GDP.

However, consumer behavior can be complex and nuanced.

For most of the past two years, measures of consumer sentiment have been in the dumps — largely due to inflation manifesting clearly in the rising prices of goods and services.

Yet consumer spending growth has persisted.

The explanation: Consumer finances have been in remarkably good shape thanks to a combination of excess savings and relatively low debt levels. Meanwhile, more consumers have been getting jobs, which means more consumers have been making money. If people have money, they’ll spend it.

But no economic or market narrative goes unchanged forever. The consumer tailwinds mentioned above have been showing signs of fading.

The consumer narrative is shifting in a fascinating way

In recent months, we’ve been watching excess savings shrink, consumer debt levels begin to normalize (i.e, rise from unusually low levels), and job growth cool.

These are developments that might not lead you to assume that consumer sentiment would be improving.

But believe it or not, consumer sentiment is improving.

On Friday, we learned the University of Michigan’s Index of Consumer Sentiment in July rose to its highest levels since October 2021.

On Tuesday, we learned the Conference Board’s Consumer Confidence Index in July jumped to its highest level since July 2021.

Notably, the Conference Board’s survey also found more consumers are saying their financial situation is good and fewer are saying it’s bad.

Fortunately, what we’re witnessing isn’t total madness among consumers.

While some key metrics of financial health have deteriorated in recent months, others have been improving.

Incomes are outpacing inflation

As Renaissance Macro’s Neil Dutta has been highlighting for months, real income growth has been positive (i.e., consumers’ wage growth is outpacing inflation).

According to BEA data released Friday, real personal income excluding transfer receipts (e.g. Social Security benefits, unemployment insurance benefits, and welfare payments) rose to a record high in June and has been trending higher since December.

This has as much to do with wages rising as it does with inflation cooling.

Earlier this month, we learned the consumer price index in July was up just 3% from a year ago, the lowest print since March 2021.

Among the biggest forces bringing down inflation were energy prices, which were down 16.7% from year-ago levels. Gasoline prices are way down after a brutal 2022.

While policymakers tend to focus on “core” measures of inflation (which exclude volatile components like food and energy prices), headline measures of inflation can have a huge impact on sentiment as they include the prices of goods consumers confront very regularly.

“It is a good thing headline inflation has gone down a bit,” Federal Reserve Chair Jerome Powell said on Wednesday (h/t Myles Udland). “I would say that having headline inflation move down that much… will strengthen the broad sense that the public has that inflation is coming down, which will, in turn, we hope, help inflation continue to move down.”

And even though job growth has been cooling, there continue to be a lot of signs that the demand for labor remains robust.

This was recently confirmed in The Conference Board’s July survey, which showed that “46.9% of consumers said jobs were ‘plentiful,’ up from 45.4%. 9.7% of consumers said jobs were ‘hard to get,’ much lower than 12.6% last month.”

“Overall, the sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets,” University of Michigan’s Joanne Hsu said.

The Conference Board noted: “Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market.”

On the matter of rising interest rates, it’s worth remembering that the share of household debt with an adjustable interest rate is low by historical standards.

What to watch

Metrics like excess savings, consumer debt, and debt delinquencies have moved unfavorably in recent months. But none of these developments are signaling that a recession is around the corner. The metrics have only eased from their hottest levels.

But will spending hold up? This will be the key dynamic to watch in the coming months.

It’s great that consumer sentiment is on the mend. And it’s even better that real incomes are on the rise.

And generally speaking, consumer finances remain very healthy. As Federal Reserve data shows, household debt service payments remain historically low relative to disposable income.

In addition to resilient measures of consumer spending at the aggregate level, anecdotes suggest discretionary spending remains very strong: Royal Caribbean says cruise bookings are surging, Bank of America says Barbie and Oppenheimer have people out and about, and even the Federal Reserve says Taylor Swift concerts are fueling local tourism.

And like consumer behavior, the dynamics of the economy are complex and nuanced. Just because some key metrics are deteriorating doesn’t mean the economy is going down. There may be other metrics offsetting these headwinds. You just have to be vigilant and open to the possibility that big narratives can change.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

The Fed hikes rates. On Wednesday, the Federal Reserve tightened monetary policy further by raising its target for the federal funds rate by 25 basis points to a range of 5.25% to 5.5%

From the Fed’s monetary policy statement: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2% over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2% objective.”

“I would say what our eyes are telling us is policy has not been restrictive enough for long enough to have its full desired effects,” Fed Chair Jerome Powell said in a press conference.

In other words, while inflation rates have cooled significantly in recent months, they remain above target levels. And so the Fed will keep monetary policy tight for a little while.

Inflation is cooling. The personal consumption expenditures (PCE) price index in June was up 3.0% from a year ago, down from the 3.8% increase in May. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 4.1% during the month after coming in at 4.6% higher in the prior month.

On a month over month basis, the core PCE price index was up 0.2%. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 3.4% and 4.1%, respectively.

The bottom line is that while inflation rates have been trending lower, they continue to be above the Federal Reserve’s target rate of 2%.

Labor costs are cooling. The employment cost index in the second quarter was up 4.5% from the prior year, down from 4.9% in the first quarter. On a quarter-over-quarter basis, it was up 1.0% in the second quarter, a deceleration from the 1.2% gain in the first quarter.

From Wells Fargo: “The details of the ECI report are consistent with a labor market that is still tight but is gradually cooling from the scorching heat experienced last year. Compensation growth appears to have turned a corner as labor supply and demand come into better balance.”

Unemployment claims tick down. Initial claims for unemployment benefits fell to 221,000 during the week ending July 22, down from 228,000 the week prior. While this is up from the September low of 182,000, it continues to trend at levels associated with economic growth.

The U.S. economy grew. U.S. GDP grew at a healthy 2.4% rate in Q2, according to the BEA’s advance estimate (via Notes). During the period, personal consumption increased at a 1.6% clip.

Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 3.5% rate in Q3.

Most U.S. states are still growing. From the Philly Fed’s State Coincident Indexes report: “Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96. Additionally, in the past month, the indexes increased in 43 states, decreased in two states, and remained stable in five, for a one-month diffusion index of 82.”

They’re building a lot of factories. From Bloomberg: “Business investment in manufacturing facilities surged to the highest level in records that go back to the late 1950s, according to data published Thursday by the Bureau of Economic Analysis. Spending on factory construction has almost doubled in the past year, after the Biden administration passed laws that provide hundreds of billions of dollars in subsidies and other support for industries like clean energy and semiconductors.”

Business survey signals cooling. From S&P Global’s July Flash U.S. PMI (via Notes): “July is seeing an unwelcome combination of slower economic growth, weaker job creation, gloomier business confidence and sticky inflation. The overall rate of output growth, measured across manufacturing and services, is consistent with GDP expanding at an annualized quarterly rate of approximately 1.5% at the start of the third quarter. That’s down from a 2% pace signaled by the survey in the second quarter.”

Keep in mind that during times of stress, soft data tends to be more exaggerated than actual hard data.

New home sales jump. Sales of newly built homes (via Notes) fell 2.5% in June to an annualized rate of 697,000 units.

Home prices rise. According to the S&P CoreLogic Case-Shiller index (via Notes), home prices rose 1.2% month-over-month in May. From SPDJI’s Craig Lazzara: “Home prices in the U.S. began to fall after June 2022, and May’s data bolster the case that the final month of the decline was January 2023. Granted, the last four months’ price gains could be truncated by increases in mortgage rates or by general economic weakness. But the breadth and strength of May’s report are consistent with an optimistic view of future months.”

Consumer confidence is up. From The Conference Board’s July Consumer Confidence report (via Notes): “Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations… Headline confidence appears to have broken out of the sideways trend that prevailed for much of the last year. Greater confidence was evident across all age groups, and among both consumers earning incomes less than $50,000 and those making more than $100,000.”

Labor market confidence improves. From The Conference Board: “46.9% of consumers said jobs were ‘plentiful,’ up from 45.4%. 9.7% of consumers said jobs were ‘hard to get,’ much lower than 12.6% last month.”

From The Conference Board’s Dana Peterson: “Assessments of the present situation rose in July on brighter views of employment conditions, where the spread between consumers saying jobs are ‘plentiful’ versus ‘hard to get’ widened further. This likely reflects upbeat feelings about a labor market that continues to outperform.”

Consumer spending rises. According to BEA data (via Notes), personal consumption expenditures increased 0.5% month over month in June to a record annual rate of $18.4 trillion.

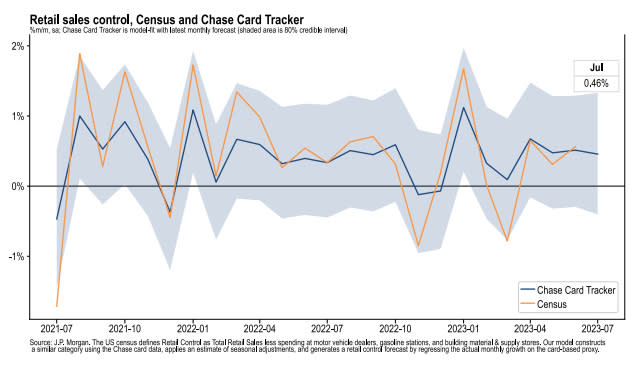

Card spending growth is positive. From JPMorgan Chase: “As of 23 Jul 2023, our Chase Consumer Card spending data (unadjusted) was 2.9% above the same day last year. Based on the Chase Consumer Card data through 23 Jul 2023, our estimate of the US Census July control measure of retail sales m/m is 0.46%.”

Putting it all together

We continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.” At its June 14 policy meeting, the Fed kept rates unchanged, ending a streak of 10 consecutive rate hikes. While the central bank lifted rates again on July 26, most economists agree that the final rate hike is near.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations) to linger.

All of this means monetary policy will be unfriendly to markets for the time being, and the risk the economy sinks into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

A version of this post first appeared on TKer.co