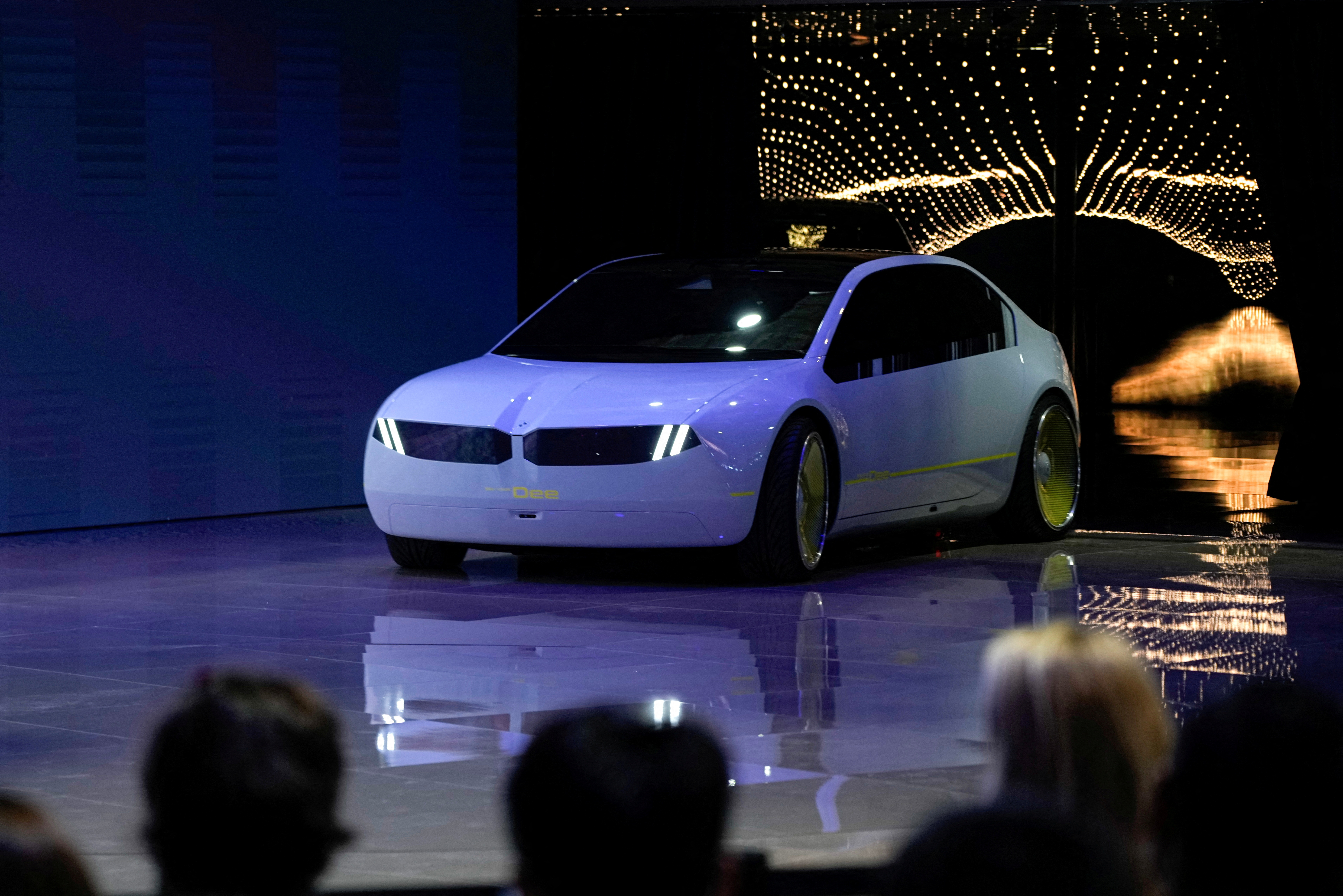

BMW’s concept model i Vision Dee is unveiled during an event at the Auto Shanghai show, in Shanghai, China April 18, 2023. REUTERS/Aly Song/File Photo Acquire Licensing Rights

MUNICH, Sept 2 (Reuters) – BMW (BMWG.DE) expects to sell more cars in China this year despite a local price war in the electric vehicle (EV) segment, and muted demand overall, the luxury carmaker’s chief financial officer (CFO) said at the IAA car show in Munich.

In his first interview since becoming finance chief in May, Walter Mertl told Reuters that BMW had been able to grow 3.7% in China in the first half, faster than the world’s top auto market as a whole, and expected this trend to continue.

“We are assuming, and we are seeing this at the moment, that we will sell more this year than last year,” Mertl said with regard to China, adding that the price war was predominantly affecting the cheaper segments of the auto market, where BMW is not active.

China’s passenger vehicle sales fell for a second month in July, as discounts and government support measures failed to lure consumers wary of buying cars amid a sputtering economy and a prolonged slump in the housing market.

Price cuts made by Tesla (TLSA.O) in early 2023 have spread to numerous brands in China, with General Motors (GM.N) and Volkswagen (VOWG_p.DE) joining a fresh round of cuts in the summer.

BMW recently raised its 2023 outlook for group vehicle sales and said it expects solid growth, which is defined as anywhere between 5% and 9.9%. In 2022, vehicles sales had declined by 4.8% to around 2.4 million; in China, they were down 6.4% to 791,985.

Mertl said that the phase-out of grants to boost electric vehicles in Germany would cause a temporary drop in demand. “But afterwards things will continue as normal.”

BMW, which on Saturday released details about its new electric platform “Neue Klasse”, plans to raise the share of EVs in total vehicles sold to 15% in 2023 and 20% in 2024, from around 9% in 2022.

Reporting by Christina Amann; Writing by Christoph Steitz; Editing by David Holmes

Our Standards: The Thomson Reuters Trust Principles.