Esports Entertainment (NASDAQ: GMBL) stock is up 27% this morning. This could be seen as the beginnings of a bright new dawn perhaps. Or a significant surge in speculative interest perhaps. We could also think of it as being a price rise of around a penny, which manages to make it much less exciting. Whether that rise of a penny would actually cover the spread is another matter – it would in certain sizes and not in others. What we can say is that the traffic is pretty substantial – 20 million shares so far this morning.

esports<\/span><\/span>“}”>

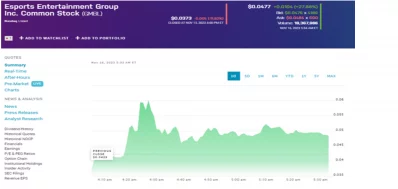

Esport Entertainment stock price from NASDAQ

So, what do we think about it? The business line is: “Esports Entertainment Group, Inc. operates as an iGaming and entertainment company in the United States and internationally. It operates through two segments, EEG iGaming and EEG Games. The EEG iGaming segment operates iDefix, a casino platform. The EEG Games segment operates ggCircuit, a local area network center management software and services for managing mission critical functions, such as game licensing and payments; and creates esports content for distribution to the betting industry.” And, well, with a market capitalisation of $3 million and change we’d suggest that’s a failed experiment in that field.

In fact, the stock’s down 99.7% over 12 months and, when we account for reverse stock splits down from a peak of a little under $2,000 a share over 5 years. The last accounts reported a $32 million loss against revenue of $23 million. That is, revenues were down near two thirds from the year before. This is not a business successfully expanding into its cost base.

There’s also no news to explain the recent share price jump. So we’d put it down to just one of those things that happens in nanocaps. It doesn’t take much buying to drive the price a bit. Therefore people do try to set off momentum trades. They also tend to fall back soon enough, the only difficulties are in guessing how far they will go and exactly when they will reverse.