Too many terminologies

Sustainable finance has been gaining widespread global attention over the last few years, and with it, an array of new terminologies such as ESG, Green Finance, and Climate Finance have emerged. While these terms are closely linked, they have important distinctions. With these terms being extensively applied across fields by various groups such as investors, government officials, policymakers, regulators, companies, organizations, and people, it is important to have a conceptual and operational understanding of what each of these stands for.

In this context, this piece attempts to provide clear explanations of what these terminologies signify, how they are interconnected, and the ways in which they are different from each other.

Sustainable finance

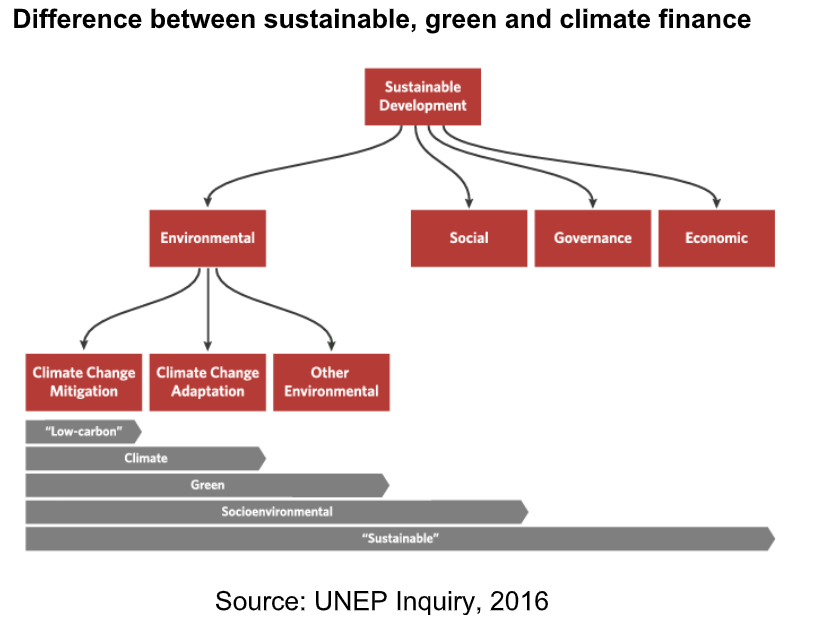

Sustainable finance covers a broader set of the investment universe, aiming to build an inclusive, economically, socially, and environmentally sustainable world. Sustainable finance is instrumental in achieving national targets such as Sustainable Development Goals (SDGs), including green activities and climate action.

Green finance

Green finance includes climate finance as well as other environmental objectives that are necessary to support sustainability, and in particular, aspects such as biodiversity and resource conservation. Green finance is a subset of sustainable finance.

Climate finance

Climate finance refers to ‘local, national or transnational financing, drawn from public, private and alternative sources of financing, that seeks to support mitigation and adaptation actions that will address climate change.’ Climate finance is necessary for countries to meet their Nationally Determined Contributions (NDCs). Climate finance is often used in international political discourse – refers to capital flows from developed countries to developing countries in the UNFCCC process.

While sustainable, green, and climate finance is related to financing, the terminologies such as ESG, Responsible Investment, and Socially Responsible Investment (SRI) are used for investment purposes. Investment is a sub-set of Finance. Finance refers to a whole range of activities in the financial system while investment is an act of buying a financial asset (stock, bonds, etc.) or real assets (plant, machine, land, etc.) to generate profit.

ESG (Environmental, Social, and Governance)

ESG is a set of standards used to screen potential investments based on a company’s environmental impact, social responsibility, and governance practices. ESG factors help investors identify and understand potential risks and opportunities associated with a company’s operations and decision-making processes.

Sustainable Investing (SI)

SI is the practice of analyzing a company’s environmental, social, and governance (ESG) risks and opportunities and making an informed decision to allocate capital.

Responsible Investment

Responsible investment is an approach that incorporates ESG factors into investment decisions to achieve sustainable, long-term returns while promoting positive social and environmental outcomes. Responsible investment seeks to promote long-term sustainable growth and avoid investments that harm society or the environment.

Socially Responsible Investment (SRI)

Also referred to as Ethical Investment, SRI incorporates an ethical dimension to investment decision-making. In this approach, certain companies and sectors are excluded from investment portfolios based on ethical considerations. For example, companies involved in arms manufacturing, tobacco, fossil fuels, or other harmful industries may be excluded from consideration.

Sustainable finance encompasses all of these elements to overarching drive action towards sustainable development.

Understanding the dynamic linkages between ESG, Green Finance, Climate Finance, and Responsible Investment is essential for effectively navigating the swiftly changing terrain of sustainable finance. In an ongoing effort to tackle urgent environmental and societal issues, these financial strategies hold significant sway in molding a future that is both sustainable and adaptable. Through a lucid understanding of these terms, decision-makers, investors, and enterprises can make well-informed choices and collaborate toward fostering a global economy that is not only more sustainable but also prosperous.

[This piece was written exclusively for ETEnergyworld by Labanya Prakash Jena, Head, Centre for Sustainable Finance, Climate Policy Initiative (CPI), and Uma Pal, Senior Analyst, CPI. Views are personal]